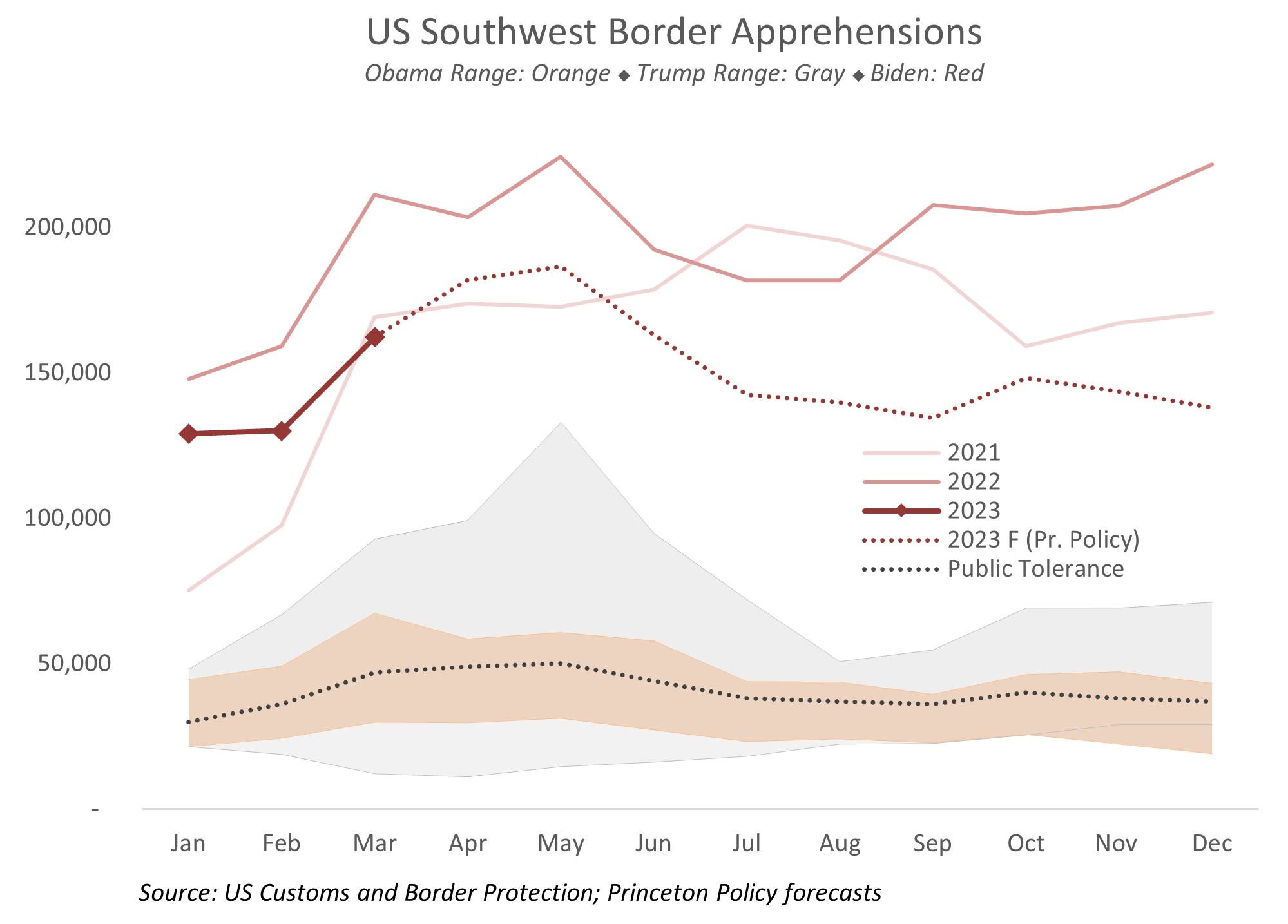

After my prior post on March apprehensions, my friends at the Center for Immigration Studies reminded me that I was, in fact, overstating the improvement in southwest border apprehensions.

In January, Customs and Border Protection implemented CBP One, which allows up to 30,000 Venezuelans, Haitians, Nicaraguans and Cubans to be admitted each month. For an apples-to-apples comparison, CBP One entrants should be added to border apprehension totals, which would make the apparent improvement somewhat less impressive.

Mark Krikorian, Executive Director of the Center for Immigration Studies, details the problems with CBP One in a New York Post op-ed:

[CBP One] did, in fact, cause a drop in illegal crossings for a couple months, as prospective illegal immigrants adopted a wait-and-see approach. [This] made sense initially, because 99% of would-be illegal immigrants who got an appointment through CBP One ended up being let in and let go. The problem is that CBP One doesn’t work especially well, and the number of slots it gives out each day is limited in any case — it’s almost a lottery as to whether you’ll get the OK. This has led increasing numbers of people, lured to the US border by Biden’s rhetoric and policies, to skip the CBP One process and just jump the border as before.

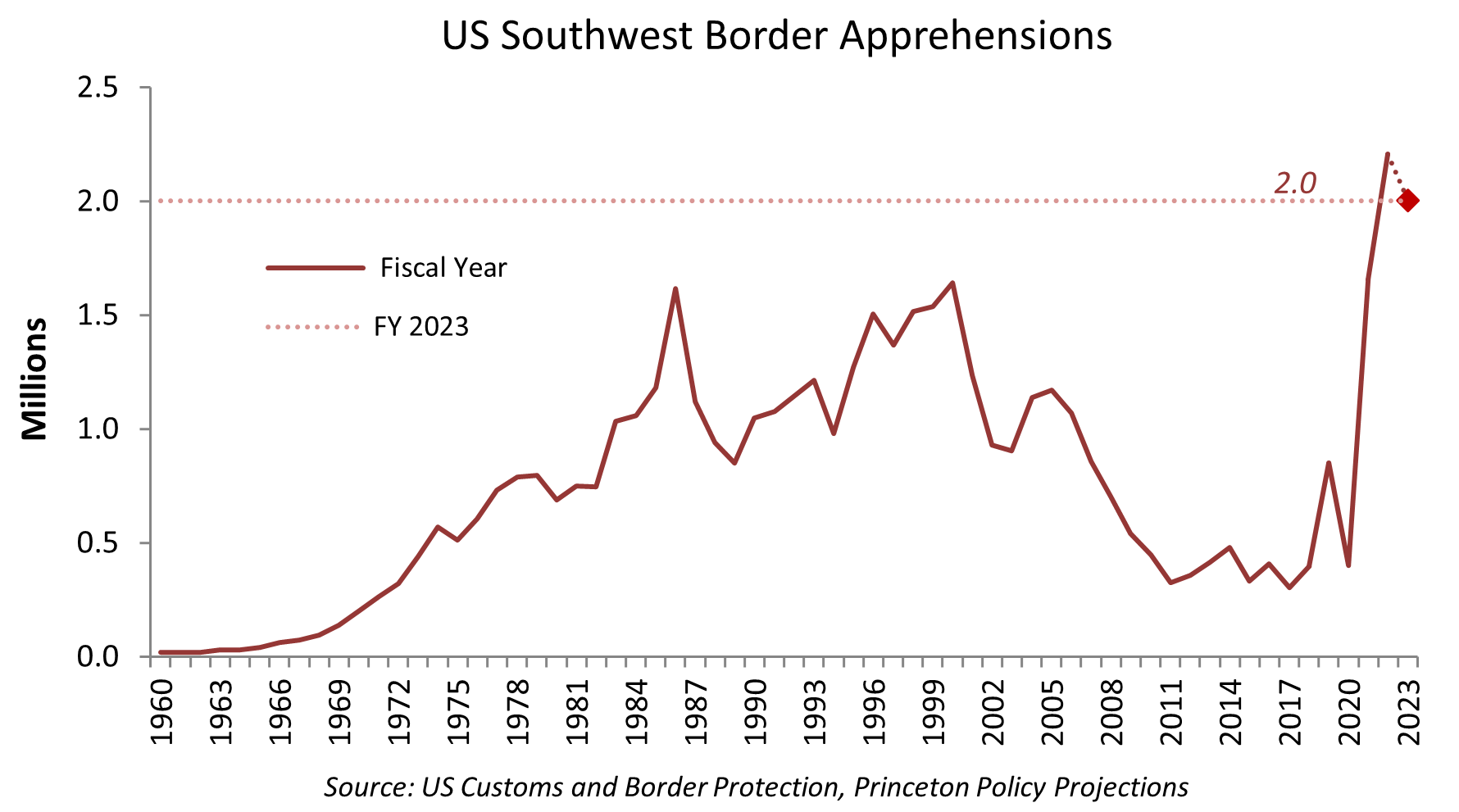

Krikorian’s critique again highlights the inherent limitations of using a quantity-based approach. If the price of the visa is set to near zero, then visa demand will vastly outstrip supply. Consider: The effective minimum wage in the US right now is about $15 / hour or $30,000 / year. Globally, 8.1 billion people live in countries with a per capita GDP below $30,000. US minimum wage can seem quite low, but for many billions of people, it would be a big step up. Therefore, any quantity-based approach like CBP One or the H2 visa programs will stock out immediately, leaving vast, residual demand. The overwhelming majority of would-be applicants who fail to make it into the program are incentivized to attempt illegal entry.

To close the border, we need a price-based approach, which involves the on-demand availability of visas at a market price. This circumvents the CBP One problem by allowing prompt access to visas by any qualified applicant at a price set by the applicants themselves for a given level of supply. The visa price should be equal to the expected present value of illegal entry. In other words, the migrant will decide whether to enter illegally or pay the visa price. If illegal entry is better, then the visa price will fall to the market-clearing level and the border should close again. Of course, the visa volumes need to be somewhere in the vicinity of underlying US business demand. To provide some indicative numbers: my current estimate of the value of a migrant work visa is about $12,000 / year, and the necessary number of visas, given a hot US labor market, may be on the order of one million.

Of course, this pushes the enforcement issue into the US interior. The visa value, $12,000 / year, is about three times the annual income of an unskilled Guatemalan. Keeping migrants legal once they enter is the hard part, of which I have written at other times.

In any event, if we accept Krikorian's line of reasoning, that the CBP One program is failing and that migrants will resume illegal entry to earlier levels, then, of course, our annual apprehensions forecast will have to be revised upward. Let's see what the data brings.