With the new administration taking office, it’s time to revisit the Price Cap on Russian oil exports.

The Price Cap and Embargo as currently structured have failed. They need to be modified, and in doing so, $50 bn in annual Russian oil revenues can be redirected to Ukraine, enough to fund much of the war, all of reconstruction, and repay the US and other allies at least a portion of the support provided.

Let’s take a look at where matters stand.

Oil Prices

Brent has moved in a relatively narrow range in the last half year and is trading near 10-year lows around $75 / barrel. Weakness in the Chinese economy is the most likely cause.

Urals, Russia's western crude oil export price, is holding around $70 / barrel and has been trading above the Price Cap of $60 / barrel since mid-2023, that is, for more than one and a half years.

At $68 / barrel at Friday close, the current Urals price is the third highest for the date in the last eleven years and well above the $56 / barrel the Russians received from 2015 to 2021 on average. Thus, Russia is earning currently $12 / barrel more under sanctions than it did before the war without sanctions.

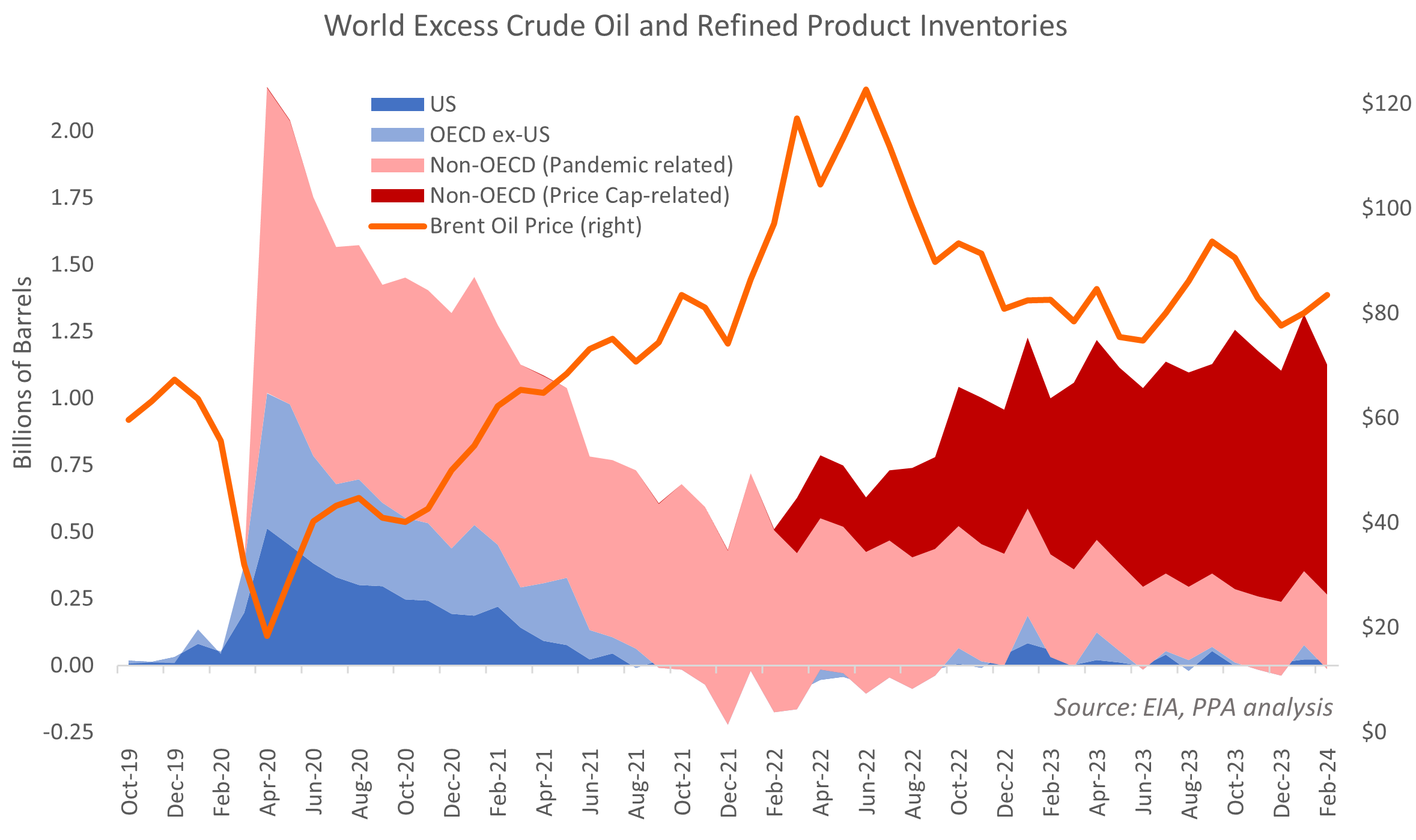

The Urals discount, the difference between the Urals and Brent oil prices, has stabilized around $6 / barrel. The current discount likely reflects greater logistics costs over longer transit routes and certain formal and informal transaction fees to facilitate the trade. As the graph below shows, the efficacy of the Price Cap lasted no more than six months, which both theory and the historical record would anticipate. A prohibition -- an enforcement-based regime -- shows initial success, but motivated buyers and sellers find alternate trading mechanisms to resume trade. Every time one route is closed, another is opened in what I have described as the Whac-a-Mole syndrome. The graph suggests that Russian oil traders achieved near total circumvention of sanctions more than one year ago.

Russian Oil Production

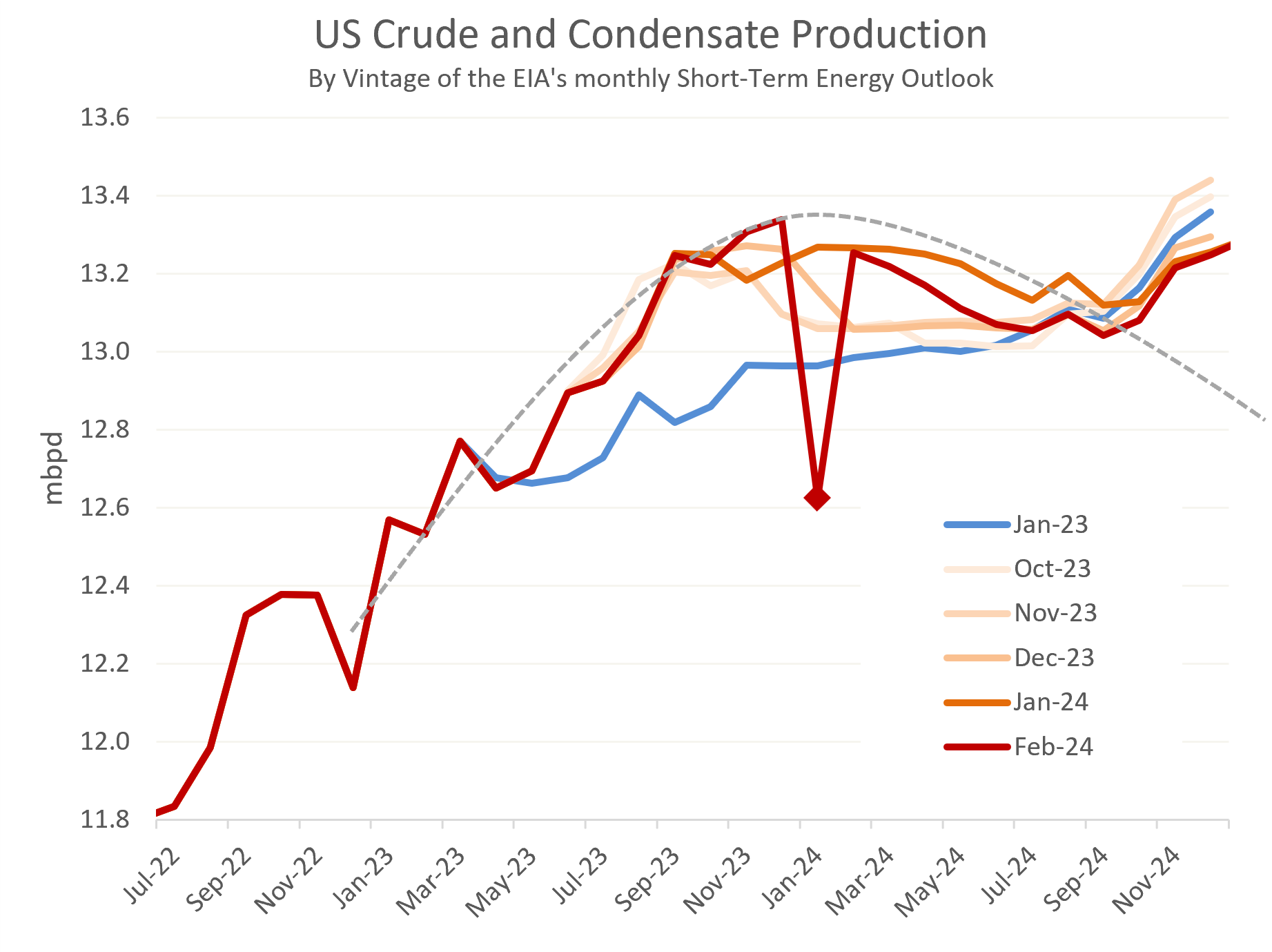

Russia has ceased reporting its oil production and export data, and as a result, the publicly available numbers are a mix of analysis, speculation and outright disinformation. The US EIA reports that Russian oil production has fallen to about 10.5 mbpd, compared with 11.3 mbpd on the eve of the war three years ago. Had there been no war, Russian oil production might reasonably have been expected to rise to around 12.2 mbpd.

Thus, current production estimates represent a reduction of 14% compared to the levels which Russia would have seen absent the war. This is consistent with the 15% reduction to the counterfactual that we have seen under prohibitions. For example, during Prohibition in the 1920s, per capita alcohol consumption in the US fell 15% compared to the level prior to the ban.

Russian Oil Exports

Russian oil exports are even more murky than production numbers. For example, the European IEA sees Russian crude and product exports at 7.3 mbpd for December, essentially unchanged since the start of the war. By contrast, the 2024 Energy Institute Statistical Review of World Energy (formerly the BP Statistical Review) reported Russian exports down by more than 1 mbpd in 2023. This is consistent with the EIA's view of Russian oil production, which sees production down 0.8 mbpd and Russian domestic consumption up marginally compared to the pre-war period. As exports are materially the difference between production and consumption, the US EIA implies a decline of exports around 1 mpbd, consistent with the Energy Institute Statistical Review and at odds with the IEA's view that exports are essentially unaffected by the war.

Notwithstanding, the point is not to argue uncertain data, but to concede that neither Russian production nor exports have been crippled by sanctions. This comes as no surprise, as it is entirely consistent with both black market theory and the dismal track record of other historical prohibitions across a range of contraband and countries.

The Shadow Fleet and the Failure of Sanctions

The imposition of sanctions in 2022 prevented western companies from transporting Russian oil in their tankers at prices above $60 / barrel. In response, the Russian government and its affiliates established their own ‘shadow fleet’ to avoid sanctions, recently estimated around 600 tankers. Of these, 276 have been sanctioned by various jurisdictions, with 213 sanctioned by the US alone.

The Biden administration sanctioned relatively few shadow fleet tankers until after the Democrats lost the election, at which time the number of sanctioned tankers quadrupled, from 54 to 213.

The Brent oil price shows why such sanctions, which could have been imposed years earlier, were delayed until after the election. The increase in the number of sanctioned vessels led to a short-term restriction in Russian supply and a surge in tanker rates, translating into a $10 / barrel increase in the price of oil in a matter of days.

No politician or bureaucrat in the advanced economies would wish to take credit for raising the price of gasoline at the pump. This includes President Trump, who has publicly called on Saudi Arabia to reduce oil prices and backed down when his proposed tariffs were set to increase fuel prices in the US Midwest.

This paradox is the central problem for Ukrainian decision-makers and analysts who continue to push sanctions on Russian oil production and exports. Ukraine’s allies simply do not want higher oil prices, and they would rather see Kyiv fall than push through a 50 cent increase in the price of unleaded on their constituents.

As a result, the sanctions regime — the Price Cap in particular — remains as porous as a sieve and no amount of carping from the Zelenskyy administration is going to change that.

The lamentable part of the story is that is was all predictable far, far in advance. My readers will know that I highlighted these risks six months before the Cap was even implemented. This was no accident. Politicians love prohibitions, and therefore sanctions on Russia were almost certain to be in the form of prohibitions, which would then predictably fail, as they have done.

Fixing the situation is a straight-forward matter, a topic for future post.