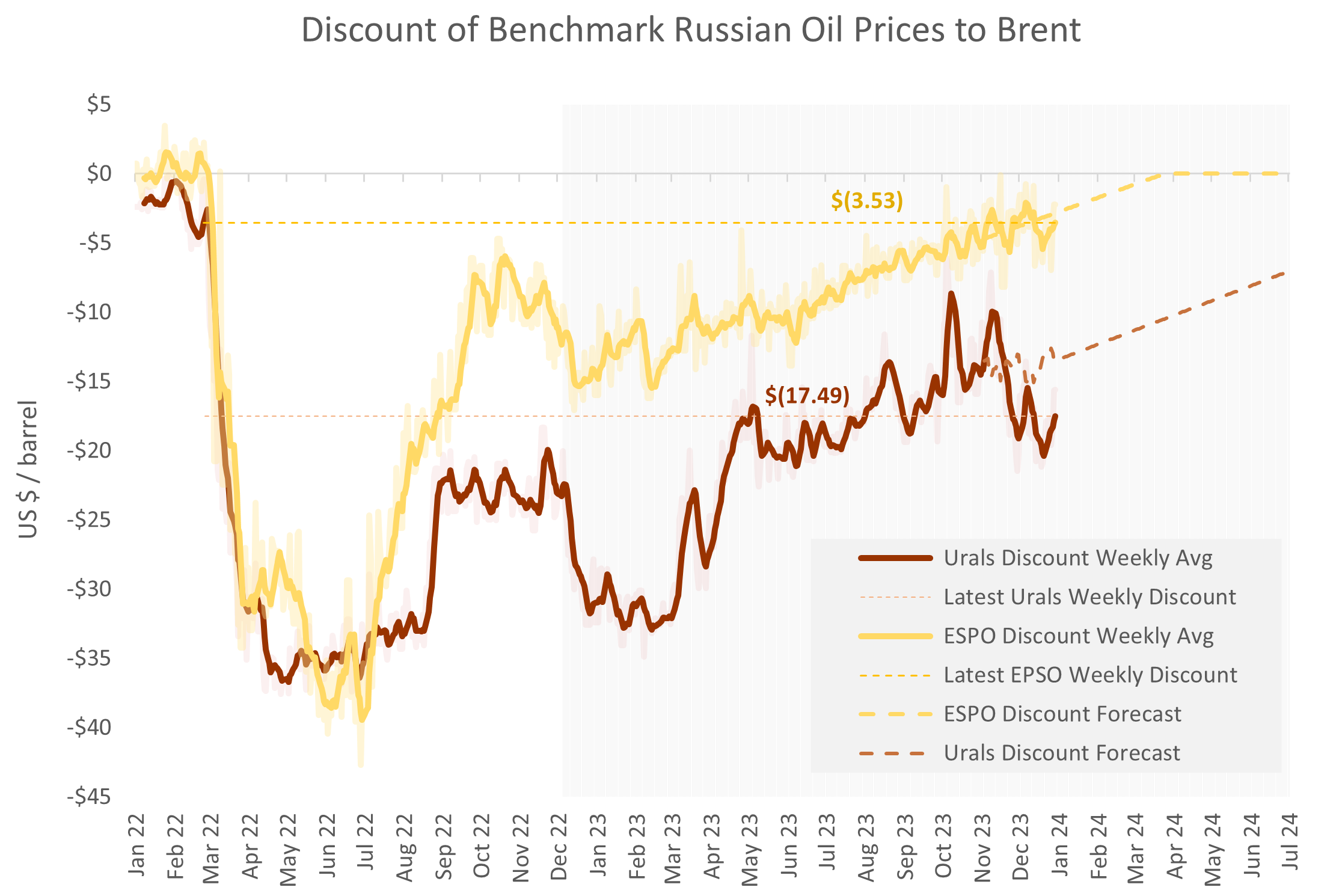

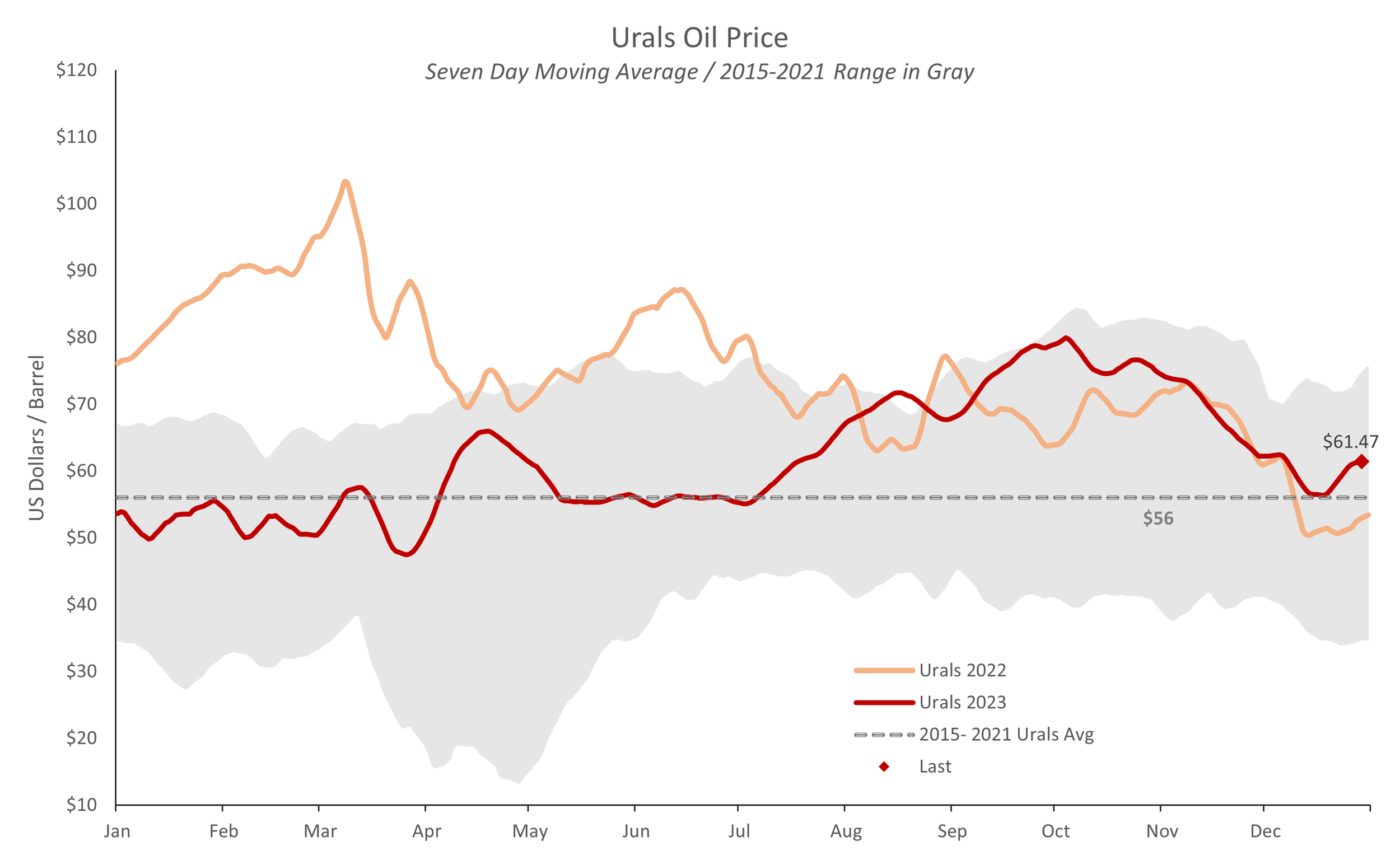

At this point, therefore, we can claim that the Price Cap mechanism is riddled with holes, even assuming that the Price Cap were enforced and effective on the Urals trade carried on western tankers. Readers know that I have been harshly critical of the Price Cap, even months before it was implemented. We now have an additional reason: the Biden administration's analytics (including those of the Fed and Treasury) were weak. This, coupled with a technically deficient structuring of the Cap, has led to enforcement better described as nominal than substantive.

Hamas, Israel, and the Partition of Gaza

The majority of Ukraine watchers have weighed in on events in Gaza. I will take similar liberties.

The press and media commentators continue to refer to Hamas militants as terrorists, and certainly, the description is apt. Nevertheless, an invasion of 1,000 Hamas fighters killing more than one thousand Israelis is not a terrorist act. It is an act of war. The term 'terrorist' creates the impression that Hamas fighters were somehow an extremist, splinter group, acting without the approval or support of Gaza's government and against the will of Gaza's population. This is untrue. The attack was planned by Hamas and justified by its military chief, Mohammed Deif, as a response to "Zionist colonial occupation". The assault on Israel was a policy decision of and implemented by the government of the Gaza Strip.

The degree of public support in Gaza is a more nuanced question. Hamas won Palestinian elections in January 2006, and no open elections for the government of the Gaza Strip have been held since. Hamas remains in charge. Palestinian opinion polling from this past summer suggests that Hamas would have won an election there prior to the attack on Israel. Nevertheless, a Washington Institute poll from July 2023 concludes that, while a "majority of Gazans (65%) did think it likely that there would be “a large military conflict between Israel and Hamas in Gaza” this year, a similar percentage (62%) supported Hamas maintaining a ceasefire with Israel." Did the Palestinians in Gaza support the attack on Israel? Condemnation by Palestinians of the attack on Israel has been muted to non-existent. The polling data suggests that many Gazans support violent confrontation, but perhaps not a majority. Reuters reports that US Secretary of State Blinken said he knew that Hamas did not represent the Palestinian people or their legitimate aspirations. The polls say otherwise.

A terrorist act that kills a dozen victims will prompt a limited response, for example, the targeting of leadership with precision airstrikes or commando raids to free hostages. The murder of one thousand civilians falls into an entirely different category. The US treated the 9/11 attacks, which killed 3,000, as acts of war and invaded and conquered two countries as a result. The 1,400 Israeli victims would represent nearly 50,000 deaths in the US, adjusted for population. Like the US after 9/11, Israel will treat the recent attacks as acts of war by the government and people of Gaza, not merely one-off acts of terrorism by lone-wolf extremists.

Unlike the US, which invaded Afghanistan and Iraq purely as disciplinary measures without the intent to take land, Israel will take land over punishment. Israel cannot invade the Gaza Strip and govern it as the US did Iraq and Afghanistan. In Gaza's dense, urban environment, the risks and complications are unpalatable. Instead, both opportunity and necessity drive Israel to take territory. By attacking Israel on such a large scale, Hamas has opened the door for Israel to seize land which conservative Israelis consider organic to greater Israel. Such an opportunity may occur only once or twice in a century, and it may not be wasted. Further, Israel's failure to detect and counteract the Hamas incursion represents a catastrophic failure of leadership. By any reasonable measure, Prime Minister Benjamin Netanyahu's career should be finished. His only saving grace could be the annexation of a substantial portion of the Gaza Strip. This would make fallen Israelis not victims, but soldiers and martyrs whose blood has secured Israel's historic lands. It may just redeem the Prime Minister's reputation. As a political necessity, therefore, Netanyahu must seize part of Gaza.

Plans are being implemented. The first step is to clear north Gaza, including Gaza City, of its Palestinian inhabitants. The expulsion of the local population is well underway. Further, every edifice in north Gaza will likely be razed to prevent talk of return, ever. This, too, is already in process. Finally, a new border must be designated, and one has been: the Besor Stream in the Wadi Gaza, about halfway down the Strip. If north Gaza is cleared of its Palestinian population, its structures destroyed and the rubble cleared; and if only Israeli Defense Forces remain beyond the wall to be constructed north of the Wadi Gaza Reserve, then Israel will have annexed half of Gaza as a practical matter.