WTI and Brent have been rocketing up, respectively at $93 and $96 at writing. (For those interested in the oil market dynamics, see my presentation from Italy last month. I'll have a separate post on this).

Urals continues to track Brent, with Urals at writing posted at $78.12. Given the surge in Brent, we might expect to see Urals at $80 / barrel in the next week or so, $20 higher than the $60 Price Cap.

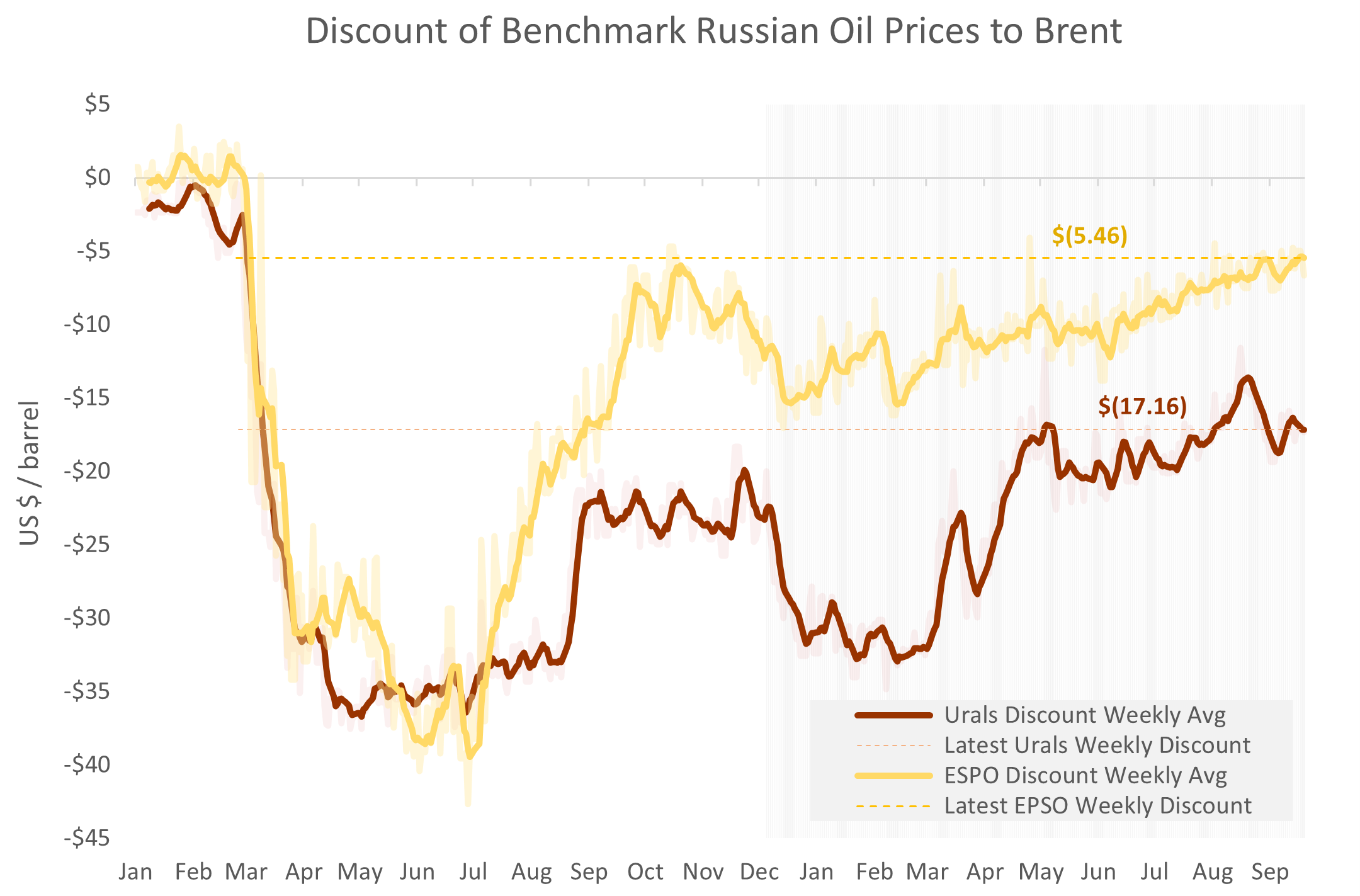

The Urals discount is largely holding steady, about $17 at writing. I expect the discount to narrow over time. The ESPO discount continues to shrink, again per expectations.

Urals is now $22 / barrel above the average for the 2015-2021 period and near a peak for the week in the last nine years. With ESPO at $89, Russia's blended crude oil export price is just about $80, sufficient to double Russia's military budget compared to the pre-war period (assuming Russia can repatriate those earnings).

The ruble continues to hold up, near 97 rubles / USD. There has been no collapse. Russia's central bank is doing its share, raising benchmark interest rates to 13%. I would note that there is no such thing as 13% interest rates in the 5-7% inflation environment Russia's central bank projects for 2023. Inflation is likely substantially higher, as I have argued, because the Kremlin is funding the war in part by printing money. With the increase in oil prices, this pressure may ease, and it is not inconceivable that the ruble will stabilize near its current range. Much depends on the evolving nature of Russian federal outlays, including for the war, as well as the portion of oil export earnings Moscow is able to repatriate.

The Biden administration's proxy at Brookings has defended the Oil Price Cap. The author, Benjamin Harris, was one of the program's architects. I am not certain his analysis is intended as a defense of the Price Cap; perhaps it is better read as a eulogy. Defending the Cap is exactly the wrong response, because surging Brent and WTI will make a mockery of the supporting arguments. Americans are not going to care a whit about rationalizations. They are going to care about pump prices, with Republican candidates pillorying the Biden administration for its incompetence in constructing the program, and justifiably so. The Price Cap needs to be fixed, not defended in its current form.