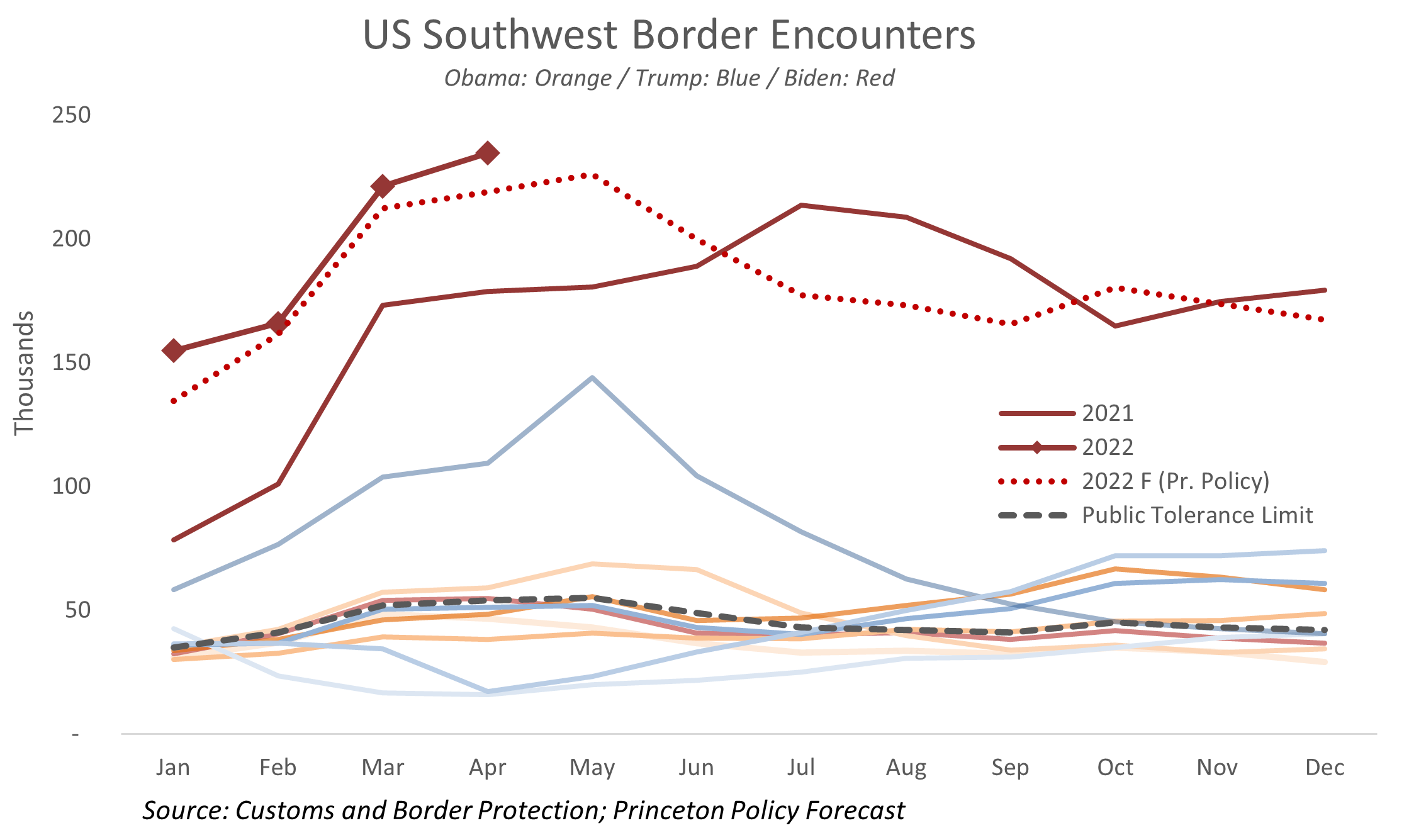

Southwest border encounters, comprising both apprehensions and inadmissibles, hit an all-time record of 231,000 in April, surpassing the previous record set in March 2000.

This aggregate number nevertheless obscures important underlying dynamics.

April apprehensions at the southwest border totaled 201,800, comfortably a record for the month back to 2000. Nevertheless, apprehensions declined during a time of year when we would expect them to rise, even if the drop was a relatively minor 2,000 persons compared to the prior month.

Apprehensions also came in about 10,000 below forecast. Moreover, apprehensions likely include Ukrainians fleeing the war, that is, non-economic migrants. Thus, the underlying apprehensions count may be in the 190,000 range, which would be both an improvement over the prior month and about 10% below our forecast level.

The interesting action this month occurred in inadmissibles, those presenting themselves at official border crossings without appropriate documentation. Inadmissibles soared to nearly 33,000, a number unprecedented in modern times. Virtually all of the growth comes from the 'Other' category, that is, not Mexicans, Guatemalans, Hondurans or Salvadorans. Although Customs and Border Protection does not specify nationality, we can assume that these were principally Ukrainians.

If we remove an estimated 25,000 Ukrainians from the April numbers, then the underlying pace of encounters, including both inadmissibles and apprehensions, probably totaled around 210,000. This is still an extraordinarily high level, but down about 10,000 from March.

Declining apprehensions may not be an unalloyed cause for celebration, however, as border apprehensions are sometimes a leading indicator for the US job market. With the stimulus now unwinding, President Biden expects the federal budget deficit to decline by $1.5 trillion this year, a number already achieved for fiscal year 2022. Such a decline represents 7% of GDP, which would ordinarily be expected to trigger a steep recession. About $400 billion of this might show up in a reduction in net imports, with the remaining $1.1 trillion associated with declining economic activity in the US.

This unwinding may well result in a reversing of certain trends seen during the pandemic. For example, whereas stock outages were common in stores during the pandemic, Walmart and Target both saw soaring inventory levels during Q1, with the former's inventory up a stunning 33%. We may expect to see similar surplus replacing scarcity across the retail space and, by implication, putting downward pressure on prices.

Surplus goods may imply surplus labor. We operate under the assumption that most undocumented immigrants come to the US to work and, moreover, are reasonably well-informed about labor market conditions before they undertake the journey north. With vast numbers of undocumented migrants entering the country since President Biden took office, the supply of unskilled, undocumented labor may be catching up with demand as the market turns. Apprehensions may become subject to trends similar to those witnessed in the retail sector. If that is the case, apprehension levels may decline materially as we head into the back half of the year. That would be good news for the Biden administration heading into the November elections were it not a reflection of distress in the economy. (I would add that President Biden now holds the record for the lowest approval rating at this point in a presidency, worse even than the prior record holder, Donald Trump.)

For now, we can state that the underlying rate of apprehensions declined in April, although it remains at historically high levels. If we are to take a guess about the future, expect apprehensions to trend downward for the balance of the year, possibly materially.